Statuses

Transaction

Authorized

The processor authorized the transaction. Your customer may see a pending charge on his or her account. However, before the customer is actually charged and before you receive the funds, you must submit the transaction for settlement. If you do not want to settle the transaction, you should void it to avoid a misuse of authorization fee.

Authorization expired

The transaction spent too much time in the Authorized status and was marked as expired. Expiration time frames differ by payment instrument subtype, transaction type, and, in some cases, merchant category.

| Payment instrument subtype | Transaction type | Time before expiration |

|---|---|---|

Visa ¹ | Default | 7 days |

Merchant-initiated transactions:

| 1 day | |

Customer-initiated transactions created by the following merchant categories:

| 31 days | |

Customer-initiated transactions created by the following merchant categories:

| 1 day | |

Customer-initiated transactions created by the following merchant categories:

| 7 days | |

Mastercard ² | Preauthorization Default | 30 days |

| Final Authorization Default | 7 days | |

Merchant-initiated transactions:

| 7 days | |

| American Express | Default | 7 days |

| Lodging & Cruise Lines | 30 days | |

Discover Diners Club UnionPay JCB | Default | 30 days |

| PayPal | Default | 29 days |

| Pay with Venmo | Default | 10 days |

¹ Learn more about Visa's authorization expiration timeframes in our blog. ² Learn more about Mastercard's authorization expiration timeframes in our blog. | ||

Processor declined

The processor declined the transaction. The processor response code has information about why the transaction was declined.

Gateway rejected

The gateway rejected the transaction because AVS, CVV, duplicate, risk threshold, or premium fraud checks failed, or because you have reached the processing limit on your provisional merchant account.

Failed

An error occurred when sending the transaction to the processor.

Voided

The transaction was voided. You can void transactions when the status is Authorized, Submitted for Settlement, or – in the case of certain PayPal transactions – Settlement Pending.

If the transaction is Settling or Settled, you will have to refund the transaction instead.

Submitted for settlement

The transaction has been submitted for settlement and will be included in the next settlement batch. Settlement happens nightly – the exact time depends on the processor.

Settling

The transaction is in the process of being settled. This is a transitory state. A transaction can't be voided once it reaches Settling status, but can be refunded.

Settled

The transaction has been settled.

Settlement declined

The processor declined to settle the sale or refund request, and the result is unsuccessful. This can happen for a number of reasons, but the processor settlement response code may have more information about why the transaction was declined. This status is rare, and only certain types of transactions can be affected.

- PayPal sale: We recommend checking the settlement status of all PayPal sale transactions before shipping goods or providing services to customers. To reduce these types of declines, submit your PayPal transactions for settlement either upon creation or within 3 days of creation.

- PayPal refund: We recommend contacting PayPal for details on refunds that are Settlement Declined.

- Credit card refund: Settlement declines can be hard or soft, just as with authorizations. In regions that support an immediate decline response for refunds, we will return Settlement Declined if the processor responds with a hard decline.

- Pay with Venmo sale and refund: Settlement declines can be hard or soft. We will return Settlement Declined if the processor responds with a decline.

Settlement pending

The transaction has not yet fully settled. This status is rare, and it does not always indicate a problem with settlement. Only certain types of transactions can be affected.

- PayPal or Venmo sale

- If using multiple partial settlements: Settlement Pending is a normal part of the transaction flow. The parent authorization will remain in this status until all child transactions are settled or the authorization expires. See the multiple partial settlement reference for more details.

- If not using multiple partial settlements: Almost all Settlement Pending PayPal/Venmo transactions will settle without intervention, so we always return a successful result. This statu is normally updated when a capture request encounters a transient internal system error and our system will try to recover from the failure. In general, you can expect these to be updated to Settled within a few days as we confirm their status with PayPal/Venmo.

- Credit card, Google Pay, and Apple Pay sales: You will only see Settlement Pending authorizations if you have contacted us to enable a specific API feature that uses this status.

- ACH Direct Debit sale: When an ACH Direct Debit transaction is processed, it immediately receives the Settlement Pending status, indicating that it has been successfully submitted to the banking network; the status will change within 1-3 business days. Learn more about the ACH Direct Debit settlement and funding timeline.

Settlement confirmed

The transaction was captured partially. The parent transaction will not be submitted to the

processor for settling, and will transition to settlement_confirmed. Its child transaction(s) has

been successfully captured and will be included in the next settlement batch, and depending on the

processor response, will have a status of settlement_declined or settled.

Verification

Processor declined

The processor declined the verification. The processor response code has information about why the verification was declined.

Gateway rejected

The gateway rejected the verification because AVS, CVV, duplicate, or fraud checks failed, or because you have reached the processing limit on your provisional merchant account.

Failed

An error occurred when sending the verification to the processor.

Verified

The card was verified successfully by the processor.

Dispute

Accepted

You have opted out of providing evidence for the chargeback or pre-arb.

Auto Accepted

The dispute has been automatically accepted for the best merchant experience.

Disputed

Evidence has been submitted to the customer's bank for evaluation. No action is needed at this time.

Expired

The reply-by date to submit evidence has passed and you have forfeited your right to respond to the case. This includes disputes that were accepted on your behalf because you did not respond.

Lost

The bank evaluated the dispute and ruled in the customer’s favor.

Open

The chargeback, retrieval, or pre-arb has been issued and no action has been taken yet.

Under Review

Your case is under internal review with PayPal. No action is needed at this time.

Won

The bank evaluated the dispute and ruled in your favor.

Escrow

These statuses are only for Braintree Marketplace merchant transactions.

Hold pending

The transaction will be held in escrow once settled.

Held

The transaction has settled and is now held in escrow and eligible to be released.

Release pending

The transaction being held in escrow will be released and disbursed shortly.

Released

The transaction that was being held in escrow has been released.

Refunded

The transaction that was being held in escrow has been refunded. Only full refunds are allowed for escrow transactions.

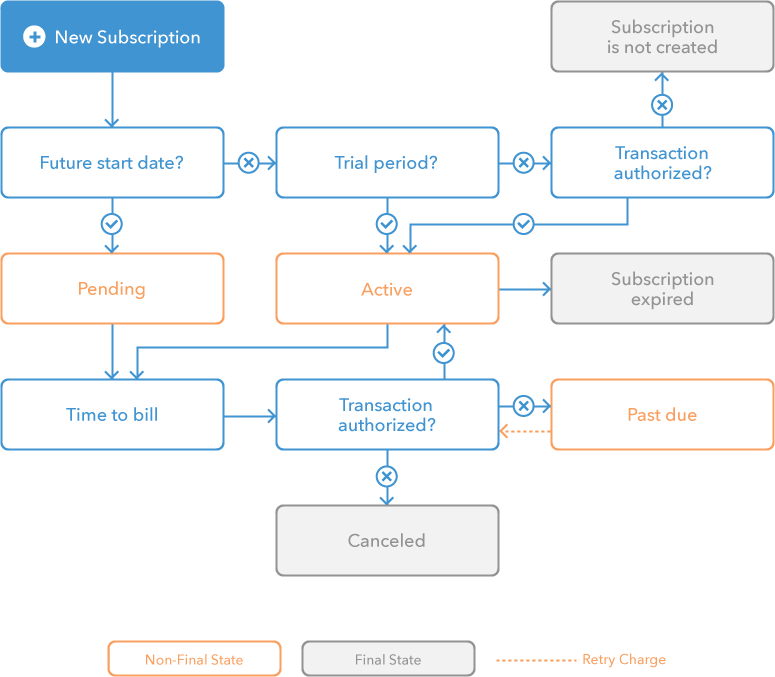

Recurring billing

Pending

Pending subscriptions are subscriptions that have not started yet. For example, if you create a subscription with a specific billing date in the future, the subscription will start out as Pending.

Active

Active subscriptions will be charged on the next billing date. You can get the dates from the subscription object. Subscriptions in a trial period are Active.

Past Due

A subscription status can change to Past Due for multiple reasons. The most common reason is a failed subscription payment. Other less common reasons for a Past Due status include that the balance is too high to be processed or issues in the merchant account setup, that would prevent a transaction from being created.

If the reason for your Past Due status is a failed subscription payment, you can manually retry the charge, or you can set up logic in the Control Panel to automatically retry a declined or failed charge at specific intervals. Additionally, a Past Due subscription will be automatically retried if the payment method associated with the subscription is updated and you have proration enabled. If the retried transaction is successful and the subscription has not passed its final billing date, the status will change to Active.

If a retried transaction is unsuccessful, the balance on the past due subscription will continue to increase every billing cycle, and we'll continue to retry the transaction each billing cycle—either indefinitely or until the number of cycles in the subscription is reached. If all retries are unsuccessful, the subscription’s status will remain Past Due until the subscription a) reaches the specified number of billing cycles and the status changes to Expired, or b) is canceled.

Expired

Subscriptions are Expired when they have reached the specified number of billing cycles.

Canceled

If you cancel the subscription, the status will be Canceled and no further billing will occur.